The Mission Lane credit card is designed for individuals who want to build or improve their credit scores. It is issued by Mission Lane, a financial services company that focuses on providing credit products with transparency, fair fees, and manageable terms, especially for people with less-than-perfect credit. To check your balance, make payments, or manage your rewards, Mission Lane Login online portal provides a user-friendly interface to make managing your account easier.

Access Mission Lane Login page and manage your credit card details, view transactions, make payments, monitor credit score, and update personal information as a Mission Lane Credit Card holder.

What is Mission Lane Credit Card?

Mission Lane is a financial technology company that offers credit cards designed for individuals who want to rebuild their credit or those who have limited credit history. With an emphasis on transparency and simplicity, Mission Lane Card offers no annual fees on their cards and provides tools to help users track their spending, improve their credit scores, and avoid common financial pitfalls.

The Mission Lane Visa® Credit Card is one of the most popular products offered by the company. It provides customers with a credit limit, the ability to earn rewards, and access to tools that simplify account management.

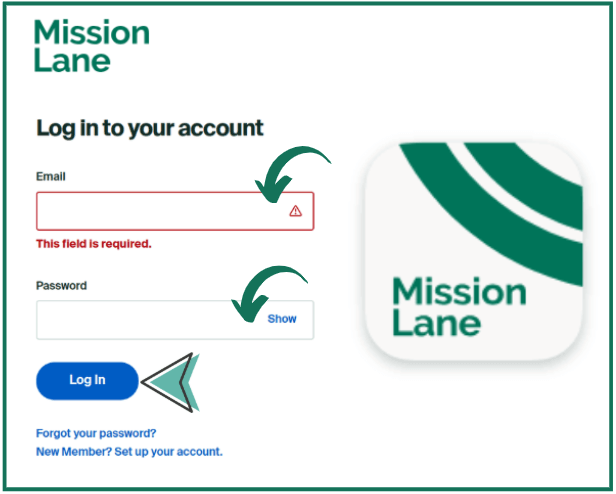

How to Access Mission Lane Login?

- Open a web browser (Google Chrome, Safari, Firefox, etc.).

- Visit the mission lane login official website at www.missionlane.com.

- Now, clock on the login option.

- Enter your Email and password in the given box.

- Finally, click on Login button to complete the process.

Access Your Mission Lane Login Account Dashboard

Once logged in, you will be directed to your Mission Lane account dashboard. From here, you can:

- View your account balance and available credit.

- Check your recent transactions and billing statements.

- Make payments or set up automatic payments.

- Monitor your credit score and track your spending patterns.

Mission Lane Credit Card Registration Steps

If you’re looking to sign up for a Mission Lane credit card account, the process is straightforward and can be completed entirely online. Whether you’re applying for a new credit card or creating an online account to manage your existing card, follow the steps below to get started.

You can Also opt for mymilestonecard

Step 1: Visit the Mission Lane Website

- Open your web browser (Google Chrome, Safari, Firefox, etc.).

- Go to the official Mission Lane website: www.missionlane.com.

Step 2: Click “Apply Now” for New Card Applications

If you’re applying for a new Mission Lane credit card, click on the “Apply Now” button, usually located on the homepage

- You may see options like “Mission Lane Visa® Credit Card” (for building or rebuilding credit) and other card offerings based on your eligibility.

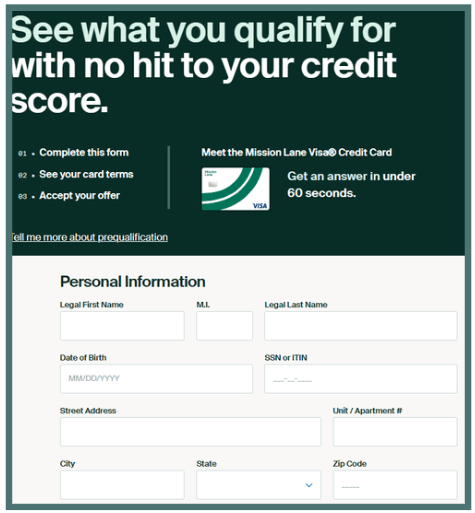

Step 3: Fill Out the Online Application Form

You will be prompted to provide some personal information to apply for a credit card, including:

- Full Name: Enter your first and last name as it appears on official documents.

- Date of Birth: You must be at least 18 years old to apply for a credit card.

- Social Security Number (SSN): This helps verify your identity and credit history.

- Address: Provide your current home address.

- Email Address: You will need an email address for communications and to create your online account.

- Phone Number: A mobile number or landline for customer support and account-related communications.

- Income Details: Some applications may ask for your annual income to assess your creditworthiness.

Step 4: Review the Terms & Conditions

Before submitting your application:

- Read the terms and conditions carefully, including any fees (such as annual fees, interest rates, etc.), payment schedules, and rewards (if applicable).

- Ensure that you understand the interest rates (APR) and fees associated with the card.

Step 5: Submit Your Application

Once you’ve completed the form and reviewed the terms, click on the “Submit” button to send your application to Mission Lane for review.

Mission Lane will evaluate your application based on factors such as your credit history and income. You may receive an immediate approval decision, or it could take a few days for them to process your application.

Step 6: Set Up Your Online Account

If your application is approved create an online account to manage your Mission Lane credit card login.

- You’ll need to choose a username and password.

- This is the same account you’ll use to access your card’s dashboard online, check your balance, make payments, and more.

Step 7: Receive Your Card

If you’ve been approved for a Mission Lane credit card, your physical card will be mailed to the address you provided during the application process. Expect it within 7-10 business days.

Step 8: Activate Your Card

Once your physical card arrives, you’ll need to activate it:

- Access mission lane credit card login account using the username and password you created.

- Follow the instructions to activate your new Mission Lane credit card.

- Alternatively, you may be able to activate your card by calling the customer service number on the back of the card.

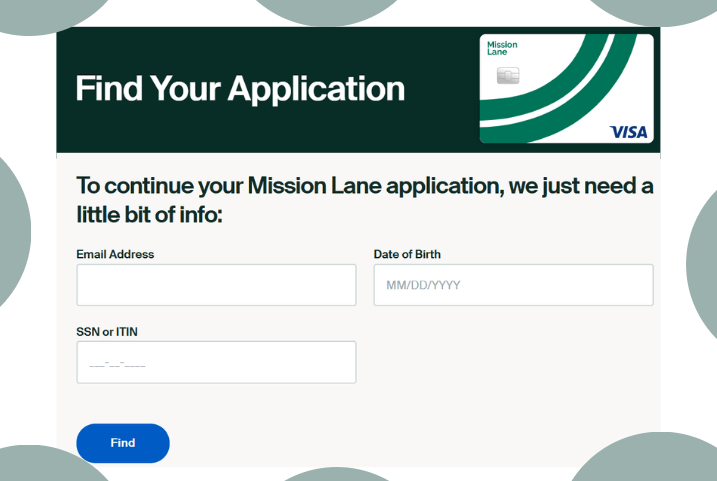

Find Your Mission Lane Application

If you’ve already applied for a Mission Lane credit card and want to check the status of your application, here’s how you can do that:

- Visit at https://apply.missionlane.com/lookup?

- You will be redirected to the Find Your Application page.

- Enetr your Email Id, date of birth.

- After that, type your SSN or ITIN.

- Click on Find option to complete the process.

Reset Mission Lane Login Password

- Visit the official Mission Lane Card website: www.missionlane.com.

- Now, select the “Forgot your password?” option.

- Enetr your registered Email.

- Now, they will send a security code to the phone number associated with the email address you provided.

- Once you will receive the code, complete the given instruction to complete the process.

Mission Lane Credit Card Payment – Pay Bills

Making a payment on your MissionLane credit card is quick and easy. Here’s a simple guide on how to pay your bill:

1. Online Payment (Via Mission Lane Account)

The fastest and most convenient way to make a payment is through your Mission Lane online account.

- Log in to your account at www.missionlane.com.

- Go to the “Payments” section.

- Choose your payment amount (minimum, full balance, or a custom amount).

- Select your payment method (bank account, debit card, etc.).

- Confirm and submit your payment.

Your payment will be processed immediately (may take 1-3 business days to appear on your account).

2. Mobile App Payment

Use the Mission Lane mobile app for easy payments on the go.

- Open the Mission Lane app (install it from the App Store or Google Play).

- Log in to your account.

- Go to the “Payments” section.

- Select your payment amount and payment method.

- Confirm and submit your payment.

Your payment will be processed instantly.

3. Payment by Phone

If you prefer, you can also pay by phone.

- Call (877) 810-4101 (Mission Lane customer service).

- Follow the prompts to make a payment.

- Provide your payment details (bank account or debit card).

- Confirm and submit your payment.

Payments made by phone are usually processed immediately.

4. Mail Payment

You can also mail your payment using a check or money order.

- Write a check or money order for the payment amount.

- Mail it to the address on your monthly statement or use the following:

- Mission Lane

P.O. Box 105286

Atlanta, GA 30348-5286

- Mission Lane

- Make sure to send payments early, as it can take several days to process.

Features of the Mission Lane Visa Card

The Mission Lane Online Portal makes managing your credit card account quick and convenient. Here are the key features, explained simply:

- View Your Balance: See your current balance and available credit at a glance.

- Track Your Transactions: Easily view all your recent purchases and payments.

- See Your Credit Limit: Check your credit limit and available credit.

- Pay Your Bill: Pay your credit card bill directly from the portal. You can choose to pay the minimum payment, full balance, or a custom amount.

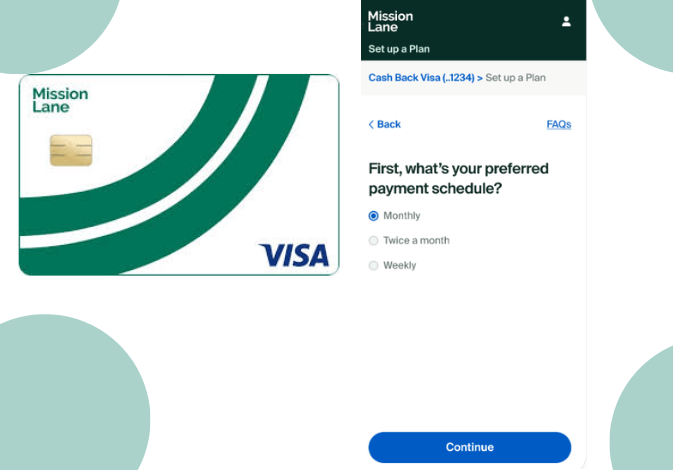

- Set Up Auto-Pay: Automatically pay your bill each month to avoid late fees and maintain your credit score.

- Access Statements: View your monthly billing statements at any time.

- Receive PDFs: Download and save your statements for your records or tax purposes.

- Track Your Credit Score: Keep an eye on your credit score through the portal. This helps you stay informed about your credit health.

- View Rewards: If your card offers rewards, you can see your earnings and redeem them directly from the portal.

- Special Offers: Occasionally, you may get offers or promotions that you can access through the portal.

- Personal Information: Update your personal details like your phone number, email, and address.

- Payment Methods: Add or update your bank account or debit card details for payments.

- Two-Factor Authentication: For added security, log in with two-factor authentication (2FA) to protect your account.

MissionLane Customer Service

- Contact Phone Number: 855-790-8860

- Mailing Addresses / Payment Address

- Mission Lane LLC, PO Box 71084, Charlotte, NC 28272-1084

- General Correspondence Address

- Mission Lane LLC, PO Box 105286, Atlanta, GA 30348-5286

- Official Website: https://www.missionlane.com/

FAQs

What is the Mission Lane credit card?

The Mission Lane credit card is a Visa® credit card designed to help you build or rebuild your credit.

How do I apply for a Mission Lane credit card?

Visit www.missionlane.com, click “Apply Now,” and fill out the online application form with your details.

Can I apply with bad credit?

Yes, the Mission Lane card is designed for people with fair or bad credit, making it easier to get approved.

How much is the starting Mission Lane Credit Card credit limit?

The starting credit limit for a Mission Lane Credit Card typically ranges between $300 and $1,000 but some cardholders report limits as high as $4,000.

How do I check my credit score with Mission Lane?

You can view your credit score through the Mission Lane online portal or the mobile app.

What should I do if my card is lost or stolen?

Call (877) 810-4101 immediately to report your lost or stolen card, and Mission Lane will suspend your account and issue a replacement card.

Mission Lane Card APR on Purchases

26.99% – 29.99% (V)

How do I close my Mission Lane credit card account?

To close your account, contact Mission Lane customer service at (877) 810-4101 after paying off your balance.

How long does it take for a payment to process?

Online and phone payments are usually processed immediately, but may take 1-3 business days to reflect on your account.

Is there any Annual Fee for Mission Lane Card?

Yes, the Mission Lane Credit Card may have an annual fee, but it depends on the specific offer and type of card you receive. Generally, the annual fee for the Mission Lane card can range from $0 to $59.

- Some users may qualify for a $0 annual fee based on their credit profile.

- For others, there may be an annual fee of around $39 to $59, depending on the terms and conditions of the card offer they receive.

- MyBKExperience

Contents

- 1 What is Mission Lane Credit Card?

- 2 How to Access Mission Lane Login?

- 3 Mission Lane Credit Card Registration Steps

- 4 Find Your Mission Lane Application

- 5 Reset Mission Lane Login Password

- 6 Mission Lane Credit Card Payment – Pay Bills

- 7 Features of the Mission Lane Visa Card

- 8 MissionLane Customer Service

- 9 FAQs